Understanding Shopper Decision Trees in Retail Shelving

Shopper decision trees (SDTs) provide valuable insights into how shoppers browse products and prioritize their choices. By understanding the hierarchy of what is most important to shoppers, we can enhance the shopping experience.

While SDTs serve as a guiding framework for organizing the retail shelf, they are not meant to be followed rigidly. Instead, they should be used to make the shopping experience more intuitive and convenient for the customer. By referencing SDTs, we can ensure that products are arranged in a way that aligns with shopper priorities, facilitating easier and more satisfying shopping journeys.

Decision 1:

Brand

Decision 2:

Life Stage

Decision 3:

Breed Size

Decision 4:

Flavor

Decision 5:

Health Benefit

Challenges Shoppers Face in Navigating the Aisle and Finding Dry Dog Food

By understanding these challenges, retailers can take steps to simplify the shopping experience, making it easier for customers to find and choose the right products.

Best Practices

for Retail Shelving

Click on a tactic to learn more

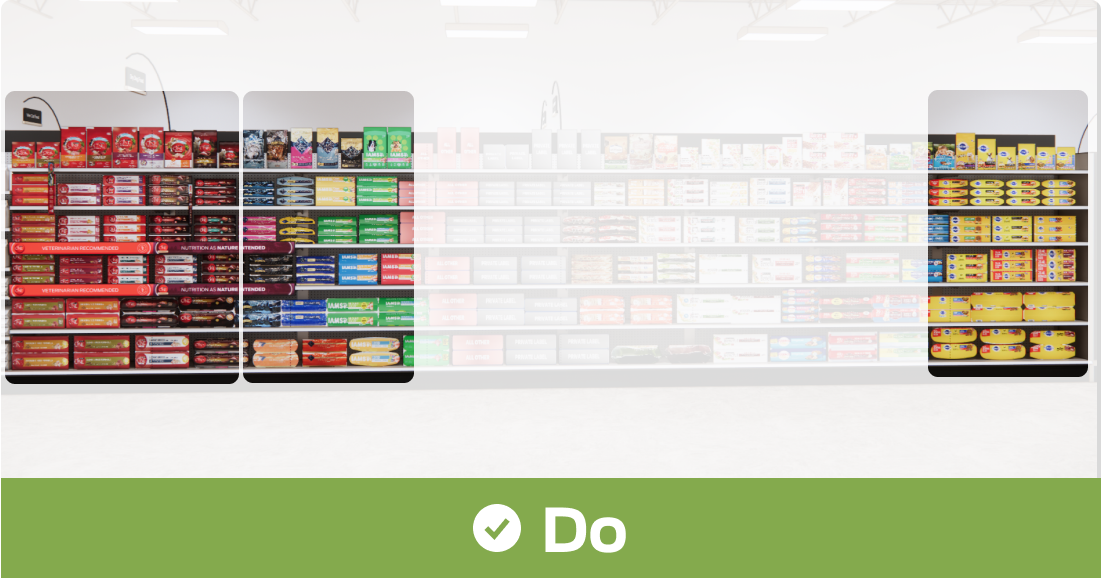

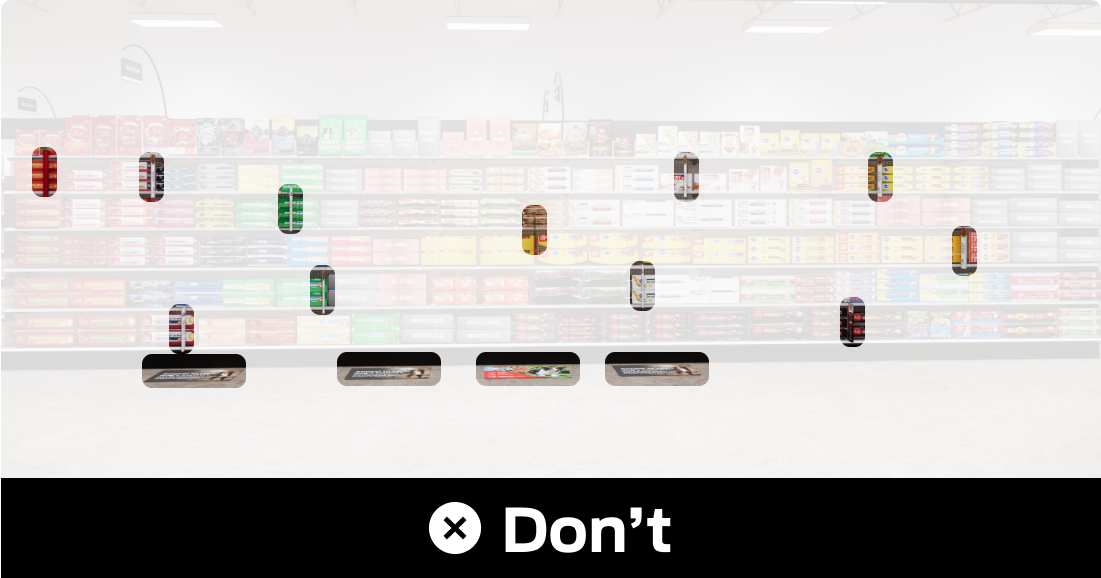

Shoppers tend to look for their preferred brand first. Vertically brand block the aisle to guide shoppers down the aisle with familiar product offerings and clear signage. Place smaller bags on the top shelves and larger bags on the bottom shelves for easy access.

Position higher-priced sublines of brands within the brand block, next to the mainline products, to encourage shoppers to trade up.

Ensure that a wide range of products is available, offering variety in brand, flavor, life stage, breed size, health benefits, bag size, and price options to meet diverse shopper needs.

- Position private label brands next to brands within their corresponding price tier. Place niche brands (with a low SKU count) in the center aisle where shoppers tend to spend more time.

Use strategies that encourage cross-purchases, such as signage or secondary placements within the dry dog food section (e.g., clip strips, hanger shelves), to promote buying wet dog food and dog treats along with dry food.

Optimizing Fulfillment Methods for Dry Dog Food

By leveraging these fulfillment methods, retailers can make purchasing dry dog food more convenient and attractive for customers, leading to increased satisfaction and repeat business.

Utilizing the PLUS Framework for the Dry Dog Food Segment

By leveraging these areas of the PLUS framework, retailers can effectively enhance their dry dog food segment, attracting new customers, broadening product appeal, encouraging premium purchases, and increasing overall consumption.

Welcome:

Target New

Households

Welcome: Offer Variety and Showcase Benefits

Ensure an optimal assortment of offerings.

Educate shoppers on benefits of dry food, particularly for puppies.

4.1M puppies are acquired each year, with most new owners feeding dry dog food. If 10% of these HHLDs purchase dry puppy food, it is a $47m opportunity.

Broaden:

Expand the Definitions of Traditional Segments

Broaden: Highlight New Ways to Purchase

Push dry dog food subscriptions and omnichannel fulfillment options to make purchasing easy.

If current dry dog food users who do not feed wet food, make 1 wet food purchase this year, it is a $32m opportunity. Potential growth is greater if these consumers have a subscription inclusive of dry and wet food.

Upgrade:

Educate Trade Consumers to Higher Price Tiers

Upgrade: Provide a Perfectly-Placed Variety of Upgraded Items

Prioritize the assortment of premiumized offerings and shelve upgraded items next to their parent-brand to encourage trade-up.

Educate shoppers on benefits of premiumized ingredient claims.

If 1/3 of premium dry dog food buyers upgrade to super premium, it is a $104m opportunity.